Free up the family home with factoring

Free up the family home with factoring

Most factoring and invoice finance facilities do not require real estate security so there is no need to use the family home to secure the borrowing facilities required to run your business effectively and improve cash flow.

Grow your business with Invoice Finance

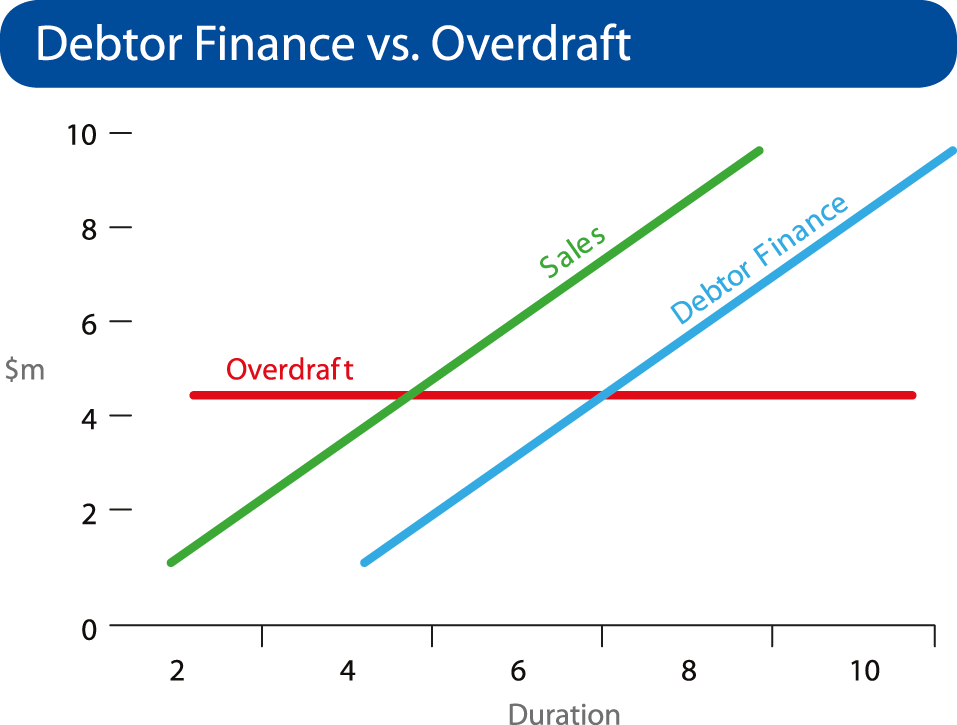

FactorONE invoice finance facility limits are based on accounts receivable balances, so the amount of cash available grows in line with sales, providing ongoing access to the funds required to complete the next order and grow the business, without having to wait 30 days or more for customers’ payments.

Take advantage of our professional collections service

FactorONE clients can also benefit from tailored collections services (statements, arrears letters and telephone follow up) allowing the owners to concentrate on growing their business rather than tying themselves up in paperwork trying to manage debtors and cash flow.

No need to continually re-negotiate facility limits

No need to continually re-negotiate facility limits

FactorONE invoice finance facility limits grow in tandem with sales, so there is no requirement to continually negotiate revised arrangements to maintain working capital.

Contact Us today to see if our facilities can assist your business.