This edition we give an update on current issues for SMEs and the wider business world. Our team at FactorONE wishes you good luck for a great sales season, all the best for Christmas and the New Year and every success for your business in 2015.

This edition we give an update on current issues for SMEs and the wider business world. Our team at FactorONE wishes you good luck for a great sales season, all the best for Christmas and the New Year and every success for your business in 2015.

Greg Charlwood, General Manager

Are Prompt Settlement Discounts Worthwhile?

Prompt Settlement Discounts are in the news because a Federal Government discussion paper on the topic is about to be released (see detail below). It's timely to take a look at what these discounts actually offer for small business.

The purpose of the paper was to address Australia’s late payment culture and to free up the $19 Billion that is annually locked away in payments made after the standard 30 day terms. Unsurprisingly, big business was found to take longer to pay than SMEs.

The discussion paper has been circulated for comment and it is believed that the Department of Industry, Innovation, Climate Change, Science, Research and Tertiary Education is about to issue its findings.

Prompt Settlement Discounts are a means of obtaining prompt payment wherein the Debtor deducts a percentage discount for paying prior to normal payment terms.

Common terms range anywhere from 3% for paying at 14 days from invoice date to 5% for paying 7 days from invoice date.

At first glance these may not seem expensive; they may seem attractive as they are easily comparable to a business’ gross margin. The reality is that prompt settlement can be a very expensive method of enhancing cashflow.

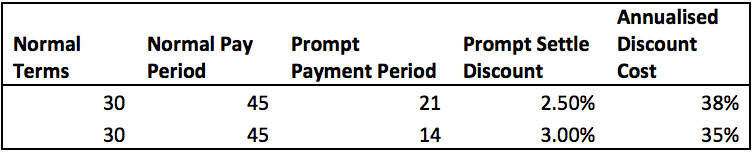

In reality, if normal terms (i.e. before negotiating prompt settlement) are 30 days end of month then the invoice is paid on average 45 days from invoice date (presuming invoices are raised progressively during the month). So, if a supplier is being paid 14 days from invoice (with a 2.5% discount), they are effectively paying 3% to be funded for a 31 day period. This is calculated based on a normal payment period of 45 days from invoice less the discount term of 14 days equals, which equals 31 days funding. In essence this equates to 35% per annum. The table below illustrates the true cost of common prompt settlement structures.

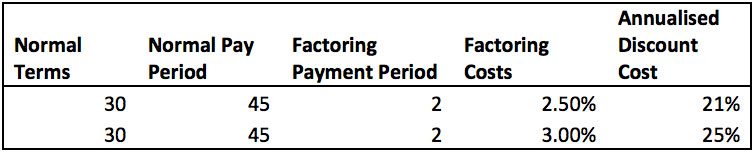

Factoring is generally much cheaper than Prompt Settlement Discounts. If you combine the charges made by the bigger independents, factoring costs around 3% of the invoice value.

The effective cost of Factoring is noted below.

So, next time a business is considering Prompt Settlement Discount they should consider factoring as it is usually a cheaper option.

State of the Economy

Personal and corporate insolvency have declined over the past year. In the 2014 financial year, 9,254 businesses went into external administration (including all types: receivership, VA etc.) compared to 10,073 in 2013. This amounts to an 8% decline – even more markedly, the September quarter comparison shows corporate insolvencies declined by 16%.

NSW saw the greatest decline at 23%, with Victoria posting a 22% decline. This would appear to be a positive sign. Personal insolvencies also declined with a 4.3% reduction in 2013/2014, though this slowed to .2% when comparing Q1, 2014 to the same quarter in 2013.

So, how does this apparently positive news compare to the wider economy?

Off the back of lower interest rates and improving housing values, consumer spending has strengthened in recent times. This has, however, been tempered by our highest unemployment rate in the last six years.

Mining investment has now passed from the build stage to the production stage. This has had a negative effect on investment and has impacted employment as fewer workers are required in the production stage. It will of course create new commodity exports, particularly in LNG as these projects get to the production stage.

Non-mining investment should increase off the back of more confidence in consumer spending, though we may not see the same level of investment as in prior cycles. This is largely due to a shift in our economy towards increased reliance on services over manufacturing. Investor and shareholder confidence is key to an increase in non-mining investment.

The strength of our trading partners is obviously important. Our key trading partners have shifted from traditional allies to Asia, which, notwithstanding the decline in China, still has impressive growth rates.

The USA is still important as it is a key driver of world economic growth, and along with the EU, is a major source of capital. The EU is in the doldrums though the USA is in recovery.

What does this all mean for us?

According to Christopher Kent, Assistant Governor of RBA, we can expect to see slow growth over the next few years with a gradual, above-trend increase in 2016.

At FactorONE we are dedicated to the growth of the SME sector of the economy. We believe that the growth in consumer spending is a boon for SMEs. We will continue to support SMEs in Australia with our cashflow facilities that will help fund investments in plant and equipment for those entrepreneurs who wish to capitalise on the expected growth in our economy.