PPSA Review

As I write this, the Attorney General has ceased taking submissions for the review of the Personal Property Securities Act. The review was built into the legislation with the intention of ensuring that the Act was achieving its aim. It was also designed to consider its impact; whether changes are required to increase efficiency and whether the act can be simplified. Some of the more relevant issues raised in submissions included:

As I write this, the Attorney General has ceased taking submissions for the review of the Personal Property Securities Act. The review was built into the legislation with the intention of ensuring that the Act was achieving its aim. It was also designed to consider its impact; whether changes are required to increase efficiency and whether the act can be simplified. Some of the more relevant issues raised in submissions included:

- The low level knowledge of the PPSA amongst SMEs;

- SME reluctance to using written contracts (needed to register a PMSI);

- The complexity of the legislation, and;

- The short timeframes that are in place to protect security interests

To date, the Invoice Finance industry has found life under PPSR to be pretty much business as usual. This is principally due to the benefits of S64 of the act which affords priority to invoice financiers over Purchase Money Security Interests (largely suppliers of inventory under a Retention of Title clause who have perfected their interest on the PPSR)

For more information on the review, visit http://www.ag.gov.au/Consultations/Pages/StatutoryreviewofthePersonalPropertySecuritiesAct2009.aspx

Business Environment

A key measure of the business environment is obviously the level of insolvencies. I was recently given the strong impression, from discussions with insolvency practitioners, that they have been relatively quiet. That is great for the business world (in general) but not so great for the insolvency industry!

The level of insolvency is of obvious interest to a financier as it can affect our risk appetite. In the case of FactorONE, an increase in voluntary administrations can be an opportunity as we do actively fund businesses in formal restructure.

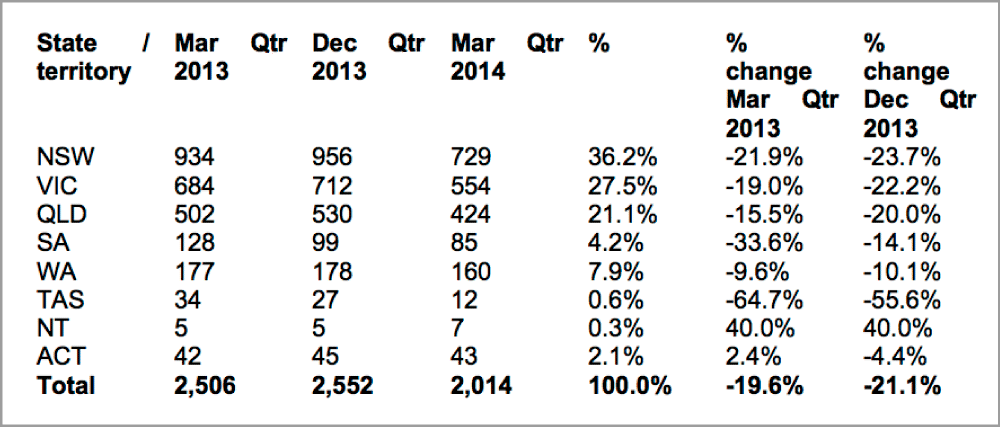

I have noted below ASICs most recent statistics on business insolvency. These figures clearly show that my IP colleagues are right, insolvencies are down in all states of Australia. Interestingly, the boom Australian state, WA, is showing the lowest fall in insolvency rates and thus indicating some of the obvious symptoms of the end of the mining boom.

Greg Charlwood - General Manager